[ad_1]

The Walt Disney Company has reported its second quarter fiscal yr 2023 earnings, beating income expectations however falling in need of Disney+ subscriber numbers. This covers the great & unhealthy of those outcomes as they associated to Walt Disney World & Disneyland, and why regardless of the sturdy headline efficiency for parks, there’s a slowdown forward.

Disney Parks, Experiences and Products revenues for the quarter elevated 17% to $7.8 billion and section working revenue elevated 23% to $2.2 billion. Higher working outcomes for the quarter mirrored will increase at worldwide and home parks and experiences companies, partially offset by decrease outcomes at merchandise licensing enterprise.

Breaking this down additional, the home parks & resorts–Walt Disney World, Disneyland, and Disney Cruise Line–reported income of $5.57 billion, up by 14% over the prior-year quarter. International parks carried out even higher, with income of $1.18 billion as in comparison with $574 million within the prior yr quarter. Consumer merchandise, which is merchandise usually that’s for no matter purpose lumped in with theme parks–and never souvenirs within the parks–really reported barely worse outcomes relative to the prior year-quarter.

Before we share the outcomes from the report, it’s value establishing a contextual background. The Walt Disney Company’s fiscal second quarter of 2023 ran from early January to late March. At each Walt Disney World and Disneyland, this encompassed a very busy winter break, Presidents’ Day/Mardi Gras/Ski Week, and early spring breaks for native faculty districts on each coasts. It additionally included some softness in January and early March, however clearly didn’t embody Easter (nor did the prior-year).

During the quarter, Disneyland opened Mickey & Minnie’s Runaway Railway and began the Disney100 Celebration with the brand new World of Color – ONE and Wondrous Journeys nighttime spectaculars. Disneyland additionally resumed Magic Key Annual Passes gross sales and introduced again the Southern California resident ticket deal. All of this helped drive attendance.

For its half, Walt Disney World launched extra resort reductions–and extra aggressive ones–as in comparison with the prior-year quarter. Technically, TRON Lightcycle Run gentle opened in direction of the top of the quarter and had affiliation previews for a couple of month previous to that. Walt Disney World additionally had the not-so-grand finale to its fiftieth Anniversary “celebration.” It’s arduous to think about that both of those latter two issues really drove attendance or spending within the quarter.

According to the corporate, working revenue development at home parks and experiences was principally attributable to a rise at Disney Cruise Line. Higher outcomes at Disney Cruise Line have been as a result of a rise in passenger cruise days together with the addition of the Disney Wish, which launched within the fourth quarter of the prior yr, partially offset by increased prices related to our ongoing fleet enlargement.

Not talked about within the report, however Disney Cruise Line nonetheless had vital well being security protocol in the course of the prior-year quarter. Discounts have been plentiful and by anecdotal statement, the ships weren’t even near filling up. So in different phrases, a giant a part of this 17% income development for parks & resorts comes all the way down to a positive comparability. There will most likely be just a little of that within the subsequent quarter with DCL and the worldwide parks, but it surely’s gone for the home parks.

To that time, the corporate reported increased working outcomes on the worldwide parks and resorts as a result of development at Shanghai Disneyland, Disneyland Paris, and Hong Kong Disneyland. The enhance at Shanghai Disney Resort was as a result of increased volumes and visitor spending development. Higher volumes have been attributable to elevated attendance whereas visitor spending development was as a result of will increase in common ticket costs and meals, beverage and merchandise spending.

The enhance in working outcomes at Disneyland Paris was as a result of quantity development, which was attributable to increased attendance, and elevated visitor spending, partially offset by increased prices. Guest spending development was as a result of will increase in common ticket costs, common each day lodge room charges and meals, beverage and merchandise spending.

The enhance in prices was primarily as a result of inflation and better prices related to new visitor choices. Higher outcomes at Hong Kong Disneyland Resort mirrored extra working days within the present quarter as a result of COVID-19-related closures within the prior yr quarter.

Finally, the corporate reported outcomes at home parks and resorts that have been barely unfavorable to the prior-year quarter, as a lower at Walt Disney World Resort was largely offset by development at Disneyland Resort. The lower at Walt Disney World Resort was as a result of increased prices, partially offset by elevated volumes. Higher prices mirrored value inflation, elevated bills related to new visitor choices and better depreciation.

The enhance in volumes was as a result of attendance development and better occupied room nights. Increased working revenue at Disneyland Resort resulted from development in attendance and visitor spending, partially offset by increased prices. Higher visitor spending was as a result of will increase in common ticket costs and common each day lodge room charges. The enhance in prices was primarily as a result of increased operations help prices and elevated prices related to new visitor choices.

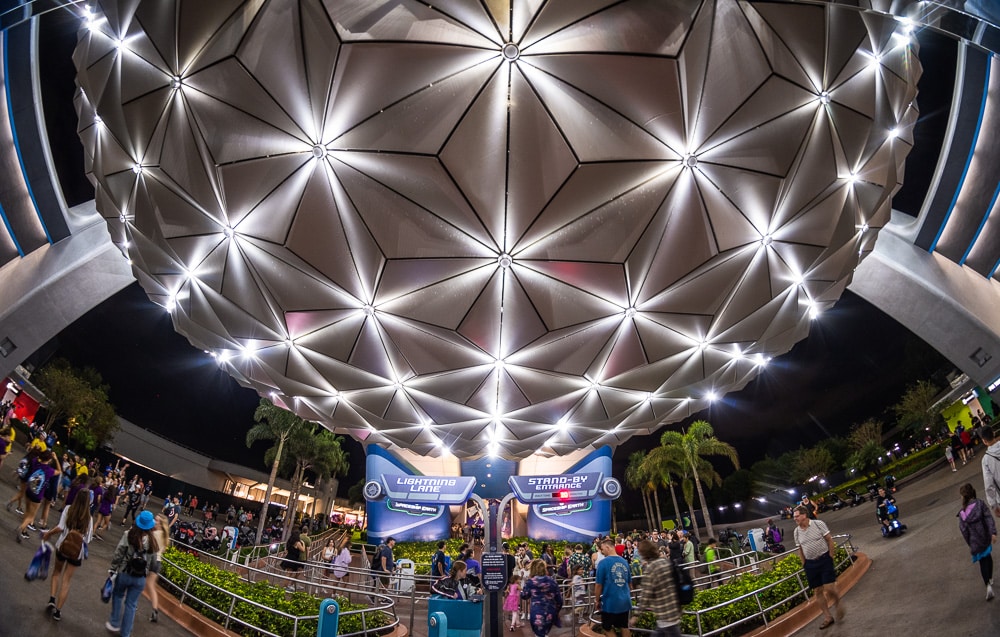

During the Q&A, CFO Christine McCarthy talked about Genie+ and Lightning Lanes as a driver of per visitor spending will increase, but additionally famous that it began to reasonable as a result of the comparability was towards the primary full quarter of providing Genie+ and Lightning Lane at each parks within the prior yr. She declined to supply a share, however gone are the times of boasting about 40% will increase on this beloved metric.

This doesn’t inform the complete story. Investors who are usually not park fanatics most likely take this at face worth, however the apparent distinction between this quarter and final yr is date-based pricing for Genie+ at Walt Disney World. On common, the each day value of the Genie+ was up considerably within the quarter; costs ranged from $15 to $29, however there have been fewer than 10 days in the course of the quarter on the $15 base worth.

This is very fascinating as a result of each attendance and lodge occupancy have been up at Walt Disney World, that means that extra folks have been spending much less. The best clarification for that is that common each day lodge charges have been down; this clarification is smart on its face, and is kind of confirmed by Disney not saying in any other case (like they did for Disneyland). But it might additionally stand to purpose that fewer company have been buying Genie+ on the increased costs or shopping for much less merchandise or in any other case minimize one thing from their trip budgets.

McCarthy additionally gave phrases of warning concerning the coming quarter (April by way of June) at Walt Disney World: “Please keep in mind that in the back half of this fiscal year, there will be an unfavorable comparison against the prior year’s incredibly successful 50th anniversary celebration at Walt Disney World. We typically see some moderation in demand as we lap these types of events, and third quarter-to-date performance has been in line with those historical trends.”

Readers, please take into account that the aim of those earnings calls is to border issues in probably the most favorable gentle attainable to Wall Street, whereas being cautious to not run afoul of the SEC or current one thing that strains credulity within the eyes of buyers. (The latter was a part of Chapek’s downfall, as he tried to spin a transparent destructive right into a constructive throughout his final earnings name.)

Again, it is a state of affairs the place you are seemingly extra educated than the typical investor; it’s secure to say that the majority of you’ll name BS on the declare that the “successful” fiftieth Anniversary Celebration was a significant driver of attendance within the second half of final yr. Even in case you give the advantage of the doubt and assume the fiftieth advertising and marketing was nonetheless doing its job to a point, that has been supplanted by the return of Happily Ever After, opening of TRON Lightcycle Run, and kickoff of the Disney100 celebration. I don’t learn about you, however I’ve a troublesome time believing that midway into its run, the fiftieth had extra drawing energy than all of that has or could have.

Obviously, McCarthy will not be going to return out and say that attendance and bookings are gentle for the rest of the fiscal yr, even after they’ve introduced again Annual Passes and began getting much more aggressive with reductions. Honestly, although, I’m a bit stunned the softness wasn’t a minimum of attributed to an externality: exhaustion of pent-up demand. (A phenomenon of which each investor on the decision is conscious because it has been mentioned by most different similarly-situated corporations.)

Perhaps Disney didn’t wish to suggest that the efficiency of the final couple years is a factor of the previous? That may clarify framing this as a blip whereas lapping the fiftieth. Regardless of the rationale, making ready buyers for an unfavorable comparability is a transfer to ‘soften the blow’ earlier than subsequent quarter’s outcomes arrive and underwhelm. Given that Walt Disney World already barely underperformed within the present quarter, when there have been no apparent indicators of a slowdown within the parks, it’ll be fascinating to see what occurs with April by way of June.

We’ve already mentioned post-spring break attendance traits in Sharp Shoulder Season Slowdown at Walt Disney World and Low Pre-Summer Crowds at Walt Disney World. Despite the deluge of disagreeing feedback on Facebook (first rule of Facebook: Walt Disney World is *at all times* busier than ever), there was a major slowdown up to now a number of weeks.

This pattern is typical between spring break and summer time, however the diploma to which it’s at present occurring will not be. The parks are slower proper now–and that goes for each coasts–than they have been on the identical time final yr or in 2021. It’s simple and apparent. (I’m sorry in case you encountered massive crowds at both in the previous couple of weeks, however there has been a drop.)

Looking ahead, there are different indicators of softness. As we’ve talked about repeatedly, Walt Disney World already has launched 14 totally different reductions for 2023, which is greater than have been obtainable for everything of final yr. Most of those reductions have been launched sooner than regular by historic requirements, and provide higher financial savings than their counterparts from the final two years. Some are superior to 2018 or 2019, however baseline costs and perks have additionally modified since then.

We’ve additionally heard anecdotal stories that, regardless of the discounting, resort occupancy numbers are nonetheless under expectations for this summer time. This explains why Walt Disney World has began pulling “levers” to assist in giving demand a shot within the arm and buoy bookings. One lever is new Annual Pass gross sales resuming. (Remember Disney’s warning that tiers have been anticipated to promote out on launch day? Several weeks later, all the things remains to be obtainable.)

It wouldn’t shock me if extra summer time ticket offers are launched for Floridians or DVC members, and maybe extra focused room offers. One outdoors risk is a summer time celebration or shock leisure. We’ll know issues are unhealthy if Disney trots out the drained previous Main Street Electrical Parade, which is the telltale signal of sentimental demand.

This can also be a part of the motivation in making 5 main adjustments to enhance the visitor expertise when saying 2024 Walt Disney World trip packages. Obviously, that doesn’t do something concerning the speedy future, but it surely ought to assist with subsequent yr’s bookings. It stands to purpose that if pent-up demand has fizzled out for this summer time, it’s additionally impacting future quarters and years.

Another purpose McCarthy’s ‘warning’ was extra measured is as a result of the state of affairs remains to be fairly removed from dire. This will probably be painted as a five-alarm fireplace by these cheering for Disney’s downfall, however that’s not actuality. A slowdown from unprecedented demand will not be a disaster, it’s a normalization. Of course, Walt Disney World would’ve beloved to keep up record-breaking numbers or that development trajectory, however even internally, they knew a slowdown was on the horizon.

All of that is what we’ve been anticipating and hoping to see for some time. Pent-up demand lasted longer than I anticipated, and albeit, it was a distortion that had unhealthy penalties for the broader economic system (past Disney). Putting that within the rearview mirror could also be unhealthy for the corporate, but it surely’s good for shoppers and the nation as an entire. Walt Disney World not doing record-breaking numbers whatever the guest-unfriendly selections and adjustments they make–and as a substitute having to truly compete for purchasers–could be very a lot a superb factor.

Other stuff was stated on the decision, with probably the most noteworthy subject to buyers being the Disney+ streaming service. I don’t wish to fixate on this an excessive amount of since it is a parks-centric weblog, however there’s no avoiding the truth that Disney’s streaming providers have an outsized influence on all the things else–together with investments at Walt Disney World and Disneyland.

Analysts had anticipated Disney+ subscriptions to achieve 163.17 million customers, development of <1%. Instead, Disney+ noticed a lack of 4 million subscribers to 157.8 million–a lower of roughly 2%. Confirmation bias being what it’s, many “fans” are going to level to this drop and attribute it to questionable content material selections or [insert personal grievance].

In actuality, except your private grievance entails cricket (the game, not the bug) that isn’t the actual clarification. Disney ceded the costly rights to Indian Premier League, which has resulted in an exodus of subscribers from India. That’s why nearly all of the above-referenced losses got here from an 8% drop in subscribers at India’s Disney+ Hotstar.

This doesn’t actually matter, although, as a result of Hotstar is tremendous low-cost. As Disney+ has shifted from a development in any respect prices mentality to 1 centered on profitability and sustainability, extra of this kind of factor will occur. The firm will hold pulling again spending in areas that have been by no means economically viable within the first place.

Revenue for streaming rose 12% to $5.51 billion for the quarter, reflecting latest worth will increase. The firm additionally noticed increased subscription income at Disney+, the place common income per consumer rose 20% to $7.14 for home subscribers. This acquire was offset by a 20% fall in income for Disney+ Hotstar, which pushed international Disney+ ARPU to simply $4.44.

On a constructive notice, Disney’s streaming losses have been smaller than anticipated, with a lack of “only” $659 million in the course of the quarter, in comparison with a lack of $841 million projected. This is the primary quarter shortly that quantity has been beneath $1 billion. That’s most likely probably the most significant quantity from our perspective, as the corporate doesn’t have a lot leeway for main capex funding at Walt Disney World or Disneyland till streaming stops hemorrhaging cash and a few debt is paid down.

Disney additionally introduced that it might add Hulu content material to the Disney+ streaming service, whereas additionally saying it might elevate the worth of its ad-free streaming service later this yr. Integrating Hulu into Disney+ suggests to us that Disney intends upon shopping for out Comcast’s stake within the streaming service. Between this and all the things else, the chances have elevated of Disney spinning off ESPN. (Just my private take–not mentioned on the decision.) That is also excellent news for future funding at Walt Disney World and Disneyland.

Planning a Walt Disney World journey? Learn about resorts on our Walt Disney World Hotels Reviews web page. For the place to eat, learn our Walt Disney World Restaurant Reviews. To lower your expenses on tickets or decide which kind to purchase, learn our Tips for Saving Money on Walt Disney World Tickets submit. Our What to Pack for Disney Trips submit takes a singular take a look at intelligent gadgets to take. For what to do and when to do it, our Walt Disney World Ride Guides will assist. For complete recommendation, the most effective place to start out is our Walt Disney World Trip Planning Guide for all the things that you must know!

YOUR THOUGHTS

What do you consider Walt Disney Company’s Q2FY2023 earnings and future forecast? Surprised that Disney+ misplaced 4 million subscribers, or unconcerned about cricket? What about per visitor spending at Walt Disney World and Disneyland, or different theme park outcomes? Thoughts on a slowdown at Walt Disney World or Disneyland? Predictions about different “levers” the corporate will pull to spice up demand and buoy bookings? Think issues will enhance or worsen all through this yr? Do you agree or disagree with our evaluation? Any questions we may help you reply? Hearing your suggestions–even if you disagree with us–is each fascinating to us and useful to different readers, so please share your ideas under within the feedback!

[ad_2]