[ad_1]

In my opinion, journey insurance coverage for solo vacationers–or any vacationers, for that matter–is crucial and, like lodging, meals, ideas, and many others., it ought to be thought-about a basic price of any journey.

Whether it is getting sick from meals in Paris or tripping on a root whereas mountain climbing in Patagonia, issues can go fallacious. You may lose gear in your travels or must cancel earlier than even leaving residence.

If you do not purchase journey insurance coverage, you’re chargeable for something and the whole lot that goes fallacious. If you do purchase, you’ll be able to declare many bills again, as I’ve, for quite a lot of issues.

- I had a pair of glasses changed that have been misplaced within the UK: $300.

- I had a crown fastened that got here off a tooth in Sydney: $272.

- I used to be refunded for a flight to Peru that I couldn’t take as a result of my mom’s unwell well being: $1,100.

The Bottom Line First: Recommended Travel Insurance Brokers

The consensus is that journey insurance coverage could be price each penny. Here are my suggestions:

- If you are American, I like to recommend TravelInsurance.com. They are an insurance coverage dealer that represents many firms. Buying on-line with them is simple however there’s a quantity to name if in case you have questions.

- If you are Canadian, I recommend Medi-Quote. I take care of a dealer when I’m shopping for from them however you’ll be able to get an nameless quote right here when you’re curious.

10 Things to Know About Travel Insurance for Solo Travelers

1. Emergency medical insurance coverage is crucial side of journey insurance coverage.

Medical emergencies could be minor and due to this fact not an enormous monetary deal. But they are often very vital and trigger critical monetary hardship.

- Emergency medical therapy can run from a day’s price range for meals to an annual wage and past. There is not any method that I might ever threat monetary spoil to avoid wasting $30 (for a youthful individual on a small journey) to some hundred {dollars}. I recommend that vacationers at all times have emergency medical protection.

- Emergency evacuation is the second necessity within the journey insurance coverage class. It is for getting you residence to your personal medical and private assist community when obligatory.

Accidents occur. It is once we are out of our regular routines that accidents are likely to occur extra usually. I used to be instructed this by an emergency room physician and this bit of data has caught. As we journey, we’re positively out of our regular routines.

It’s additionally necessary to do not forget that unusual well being points can come up simply as simply whenever you’re touring as at residence. How may I’ve identified {that a} crown on my tooth was prepared to come back off? I could not have. It did, once I was in Sydney, Australia. The emergency dental work was lined by my journey insurance coverage.

Below is a picture of a quote from TravelInsurance.com. It exhibits full protection for a $3,000, two-week journey to France beginning at US$100. For that worth, I do not know why anybody would select to not purchase journey insurance coverage.

2. You can shield your journey funding at minimal price.

While medical journey insurance coverage is critical, I think about the extra protection under as optionally available. It depends upon the worth of your journey and your willingness to endure inconvenience and monetary loss. Read on to find out whether or not these choices are necessary for you.

- Companion protection. Should you be in hospital for a time frame, your insurance coverage firm will ship a good friend or member of the family to be with you, protecting their prices and their insurance coverage. This is an important part of journey insurance coverage for solo vacationers particularly.

- Trip cancellation, interruption, or delay. This is especially necessary if in case you have bought a tour or cruise, by which case you can purchase insurance coverage as quickly as you make a deposit on a visit. When you journey independently, you do not normally put out as a lot cash up entrance, making this protection considerably much less vital.

- Trip cancellation for medical causes. Should your journey cancellation be as a result of well being points, you’ll possible be lined by the medical portion of your journey insurance coverage.

- Trip cancellation as a result of border closings, tour cancellation, or extreme climate. This is the place you need learn the journey cancellation portion of your journey insurance coverage. Have a take a look at the main points of your coverage to see what’s deemed coverable.

- Trip cancellation as a result of a well being emergency within the household. A couple of years in the past, the whole lot for my journey was deliberate however my mom fell unwell. As a main caregiver, my journey insurance coverage refunded the bills I had incurred for the journey.

- Trip interruption. The phrases for journey interruption are just like these for journey cancellation.

- Trip delay. This is often for when your journey is delayed for a day or two.

- Baggage and private results loss, theft, or injury. It could be a large inconvenience in case your baggage is misplaced. If the whole lot goes lacking by your airline otherwise you lose an merchandise whereas in your journey (as I misplaced a pair of glasses), that is the insurance coverage function that may kick in. If you will have loads of costly gear reminiscent of laptop, pictures, or sporting tools, it might be price taking images of the whole lot earlier than leaving so that you’ve got proof of possession. Baggage delay protection will usually kick in as soon as your baggage is delayed for a particular variety of hours. To keep away from the inconvenience, learn Luggage Trackers Review: How to Find Lost or Stolen Bags.

- Cancel for any motive. This is often an add-on to common insurance coverage and isn’t supplied by all insurers. It is a really costly choice and fewer frequent within the wake of the pandemic.

3. You can self-insure. When is it a good suggestion?

While I imagine in journey insurance coverage, I do not imagine in taking insurance coverage each time it is supplied (see When to Buy (and Not Buy) Insurance). I at all times advocate emergency medical protection. Depending in your threat tolerance, you’ll be able to self-insure for the protection of safety as defined above.

4. Your bank card or advantages might present sufficient protection, however you should definitely learn the small print.

Before shopping for journey insurance coverage it is best for solo vacationers to find out whether or not you are already lined by your organization well being plan or your bank card whilst you’re touring. To do the evaluation, search for the gaps between what you think about to be satisfactory protection and what you even have. This requires studying the small print.

Look on the monetary limits of the protection and whether or not you are lined within the international locations you are visiting for the size of time you may be touring. All these elements can have an effect on whether or not you will have satisfactory insurance coverage. Check for:

- emergency medical protection limits and deductibles

- phrases round pre-existing medical circumstances

- companion protection, which is very necessary for solo vacationers

- upfront fee for claims. Do it’s important to go pay for providers and get reimbursed later? Is this attainable for you?

- journey delay protection

- journey size limits

- age restrictions

- baggage loss protection

- baggage delay protection

If you’re feeling you need a bit extra protection, you should buy “top-up” insurance coverage.

5. You should buy annual or single journey insurance coverage in line with your journey plans.

When shopping for journey insurance coverage you first want to think about your journey plans for the 12 months.

If you are solely planning one or two journeys a 12 months of a few weeks every, you’ll possible be higher off with a single journey plan for every journey. Once you are as much as three journeys or journeys of longer period, you’ll want to evaluate worth and protection with annual plans.

6. There is a greatest time to purchase journey insurance coverage.

Travelers have gotten extra savvy to the pre-trip cancellation advantages.

- When must you purchase single journey insurance coverage? If you are going to purchase a full journey insurance coverage plan that features journey cancellation, purchase the insurance coverage as quickly as you set out cash for the journey. This will shield your funding from the beginning.

- When must you purchase annual insurance policy? If you’re buying a brand new annual plan primarily based on a particular journey, the recommendation above applies. If you’re renewing an annual plan, I might delay the renewal till you set down cash in your subsequent journey. There’s no have to pay insurance coverage for months whenever you’re not touring.

- When is age an element? If you may be turning a major age, reminiscent of 65, you could wish to buy your insurance coverage earlier than your birthday as the speed may very well be decrease for a 12 months.

The choice of buying insurance coverage after departure is turning into extra frequent, nonetheless, there are normally ready intervals for it to come back into impact and, if there’s a catastrophe declaration, it will not apply.

7. It’s greatest to purchase insurance coverage from skilled journey specialists.

My greatest recommendation is to make use of a journey insurance coverage dealer. Not all normal insurance coverage brokers have journey insurance coverage experience. You wish to know that the dealer is licensed and that they’re specifically skilled in journey insurance coverage.

Here are my really useful journey insurance coverage brokers:

While you should purchase journey insurance coverage from journey brokers and on-line, they’re solely allowed to promote it, they don’t seem to be allowed to offer recommendation. Basically, you are shopping for it off the shelf without any consideration of your specific circumstances. Since it is a difficult buy, I like to recommend a dealer specialist.

There are plenty of particulars to think about relating to journey insurance coverage, particularly medical protection. The language of coverage paperwork shouldn’t be at all times simple to know. If you will have questions, decide up the cellphone and get them answered clearly by both the insuring firm or a licensed journey insurance coverage dealer.

8. Ensure you get the correct journey medical insurance coverage protection.

My main aim with a journey insurance coverage coverage is to be protected against medical emergencies. To lose $1,000 on a flight is one factor. To lose tens of 1000’s on medical prices is sort of one other. When shopping for journey insurance coverage, it is necessary to know what is roofed, the bounds of protection, and deductibles.

Most journey insurance coverage insurance policies ought to cowl bills for medical consideration, paramedical providers, ambulance, emergency dental, and bills to return residence or convey household to your bedside. When searching for protection, evaluate the greenback limits out there for comparable advantages and any deductibles. For instance, two insurance policies might each provide emergency medical protection however one might provide $5,000 in protection whereas one other supplies $5,000,000. I do not suppose that something below $250,000 is satisfactory. The extra protection the higher.

Two particular concerns:

- High-risk Activities Some firms will not insure for actions like scuba diving or mountaineering. Some will not even cowl snorkeling or zip-lining. If you’re an lively traveler, make it possible for the stuff you’re inclined to do are lined.

- Emergency Medical Reunion This is a very necessary a part of journey insurance coverage for solo vacationers. Emergency medical reunion is obtainable by many insurance policies, nonetheless, the phrases can differ drastically. Again, know the precise phrases of the insurance coverage you are contemplating as a way to make a correct comparability between firms.

9. Pre-existing circumstances usually are not a deal-breaker for medical journey insurance coverage.

Before buying journey insurance coverage, solo vacationers ought to think about their pre-existing medical circumstances and the dangers related to therapy for these circumstances whereas away.

Having a pre-existing situation doesn’t imply that you’ll not be lined and it doesn’t essentially imply that the price of insurance coverage might be ridiculous.

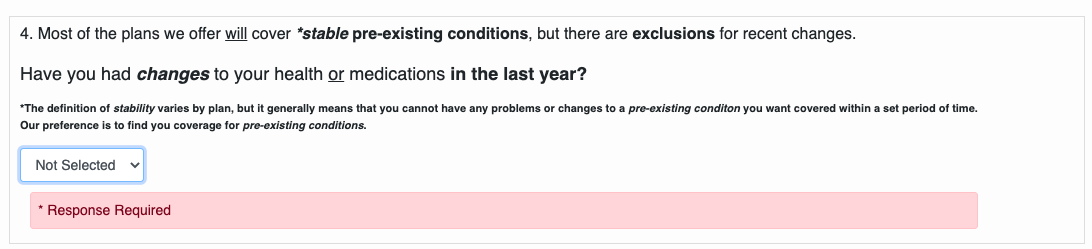

Some insurance coverage insurance policies might provide full protection for present circumstances whereas different insurance policies might require that your well being has been steady for a time frame. This is named a stability clause and it is used to restrict what the insurance coverage covers. Still others are extra involved about pre-existing circumstances as they relate to journey cancellation insurance coverage fairly than medical insurance coverage.

In some circumstances, you should buy journey insurance coverage with out finishing a medical questionnaire. While this will sound nice, it will probably imply that you’re not lined for sure pre-existing medical circumstances. In addition, in a couple of worth comparability research, I’ve discovered that insurance policies which have medical questionnaires are inexpensive than those who do not.

If you will have pre-existing circumstances, it is very important:

- learn the effective print regarding pre-existing circumstances rigorously before you purchase. Pay particular consideration to the coverage’s definition of “stable” and “treatment”. These definitions can differ and straight affect your out there medical protection.

- be utterly sincere about any pre-existing circumstances when signing up for insurance coverage in order that your coverage won’t be thought-about void for misrepresentation.

- name the insurance coverage firm so that you simply’re actually clear on what their phrases imply. For instance, if in case you have a coronary heart situation you should still be lined for a coronary heart assault as that is an unpredictable occasion. Seriously, make the decision. Their buyer assist folks could be very useful.

10. It’s important to learn the effective print to check affords.

Know the precise phrases of the insurance coverage you are contemplating as a way to make a correct comparability between firms. Download the Certificate of Insurance. This is normally out there in smaller print on any web page selling a plan or on the backside of the location below the heading, “Forms”.

Video: Experts Answer Our Questions about Travel Insurance for Solo Travelers

For extra on staying protected in your journeys, see Solo Travel Safety: 50+ Proven Tips to Keep You Safe.

Last up to date: twentieth March, 2023

[ad_2]