[ad_1]

In a brand new SEC submitting, Disney has made its counterargument towards Trian’s “Restore the Magic” marketing campaign that’s aimed toward securing Nelson Peltz a seat on Disney’s Board of Directors. This comes after a media and advertising and marketing blitz by Peltz, who’s making an attempt to make his case to followers and buyers that he can repair Disney’s faults.

We’ve already coated Peltz’s preliminary slide presentation to “Restore the Magic,” which sounds to us like a “Save Disney” remake–minus having Roy E. Disney because the face of the marketing campaign. We’ll revisit a few of that commentary right here in mild of Disney’s new SEC submitting and interviews, and additional clarify why we expect this proxy combat might be good for Walt Disney World and Disneyland followers.

Even in case you haven’t learn our half one of many “Restore the Magic” saga, there’s a great likelihood you’re already aware of this battle. If you’re lively in Disney circles on social media, there’s a great likelihood that you simply’re being bombarded with “Restore the Magic” adverts or sponsored posts. Peltz has additionally already carried out a number of interviews, with Disney responding each instantly and not directly. Suffice to say, it’s go to be a protracted and public combat.

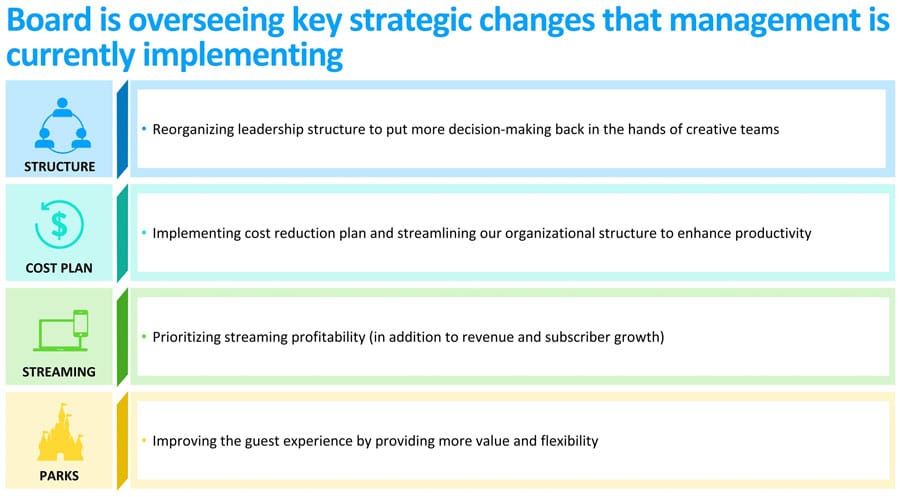

Let’s dig proper into Disney’s new SEC submitting, which is actually a Powerpoint presentation. In this, the corporate leads with the argument that the Disney Board of Directors is impartial, “highly qualified” and has “provided strong oversight focused on delivering superior, sustained shareholder value.” Disney additionally touts how the board “regularly reviews, and is heavily involved in, setting the strategic direction of the company.”

This contains the launch of the direct-to-consumer platform (DTC) and pivoting from progress to specializing in profitability. It additionally purportedly contains addressing “leadership challenge” as they emerge, with a “focus on succession.” Disney additionally factors to incoming Board Chairman Mark Parker, and the way he’s an exemplary chief for Disney, in addition to Carolyn Everson, who was added to the Board and has media experience because of her roles at Meta and Microsoft.

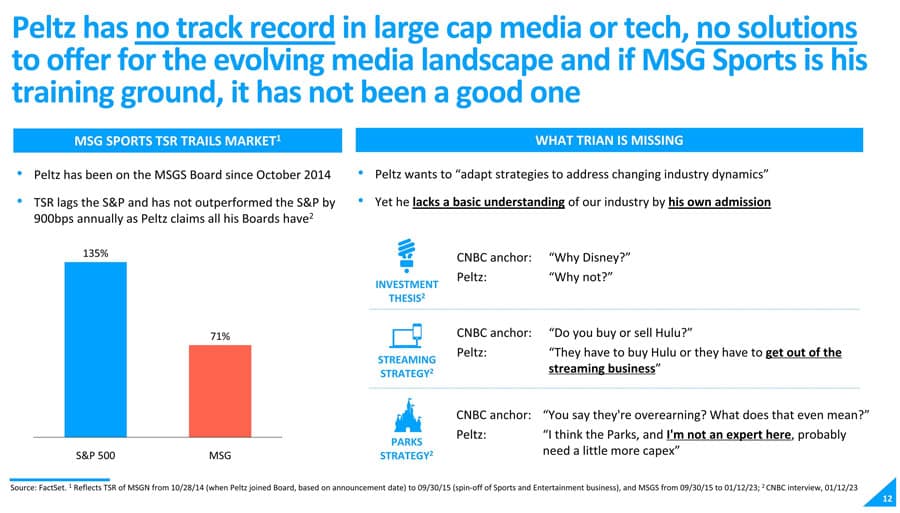

Following this, Disney dedicates a complete slide to the next assertion: “Nelson Peltz does not understand Disney’s businesses and lacks the skills and experience to assist the board in delivering shareholder value in a rapidly shifting media ecosystem.”

If Disney had been main with its strongest argument, it could be a loser. DTC is exactly the issue, and if Disney’s assertion is that the Board has carried out a great job with that–hemorrhaging billions per quarter–that’s fairly the suspect declare. Same goes for coping with management challenges and succession planning. I doubt anybody goes to present Disney’s Board excessive marks for the choice to increase Chapek’s contract solely to fireplace him a couple of months later, resulting in severance funds of over $20 million.

As for succession planning (or somewhat, lack thereof), Disney’s monitor document is well-documented. While I’ll agree with the corporate that Mark Parker is an effective selection and establishing the Succession Planning Committee is a great transfer, that occurred as Disney equipped for this proxy combat. Peltz’s straightforward retort is: “See? I’m already instigating positive changes.”

Drawing consideration to Peltz’s lack of monitor document in media is correct, however that’s not a distinction with Disney’s present board. Carolyn Everson is highlighted as a result of she has the closest factor to media expertise, and that’s by way of Meta (Facebook) and Microsoft. Not precisely apples to apples with Disney.

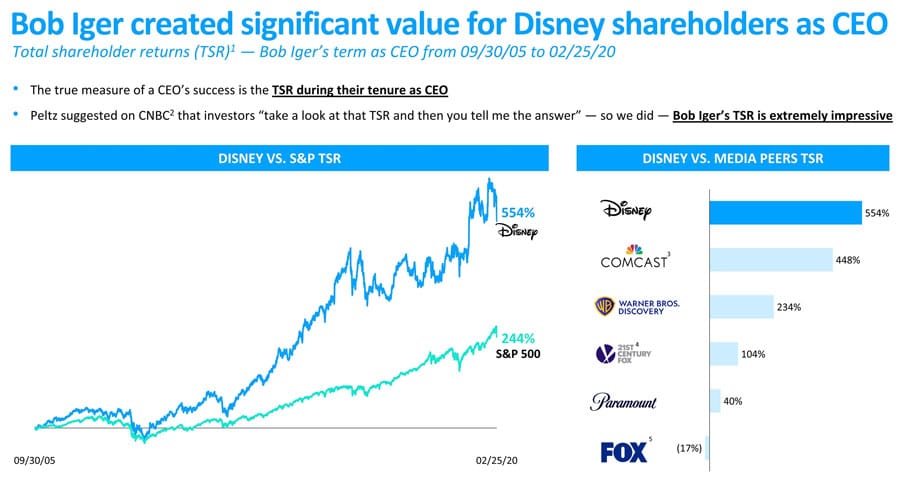

Fortunately for the corporate, Disney did not lead with its finest case towards Peltz. Following an ironclad argument about Bob Iger’s tenure and his monitor document of progress, the corporate digs deeper into its mergers and acquisitions.

Disney highlights the purchases of Pixar, Marvel, and Lucasfilm, saying they enhanced the corporate’s worth for shareholders and had been transformative for the corporate. Again, these successes are indeniable. Iger grew Disney’s portfolio into an mental property behemoth past simply animation.

Pixar has continued to carry out nicely, with the Star Wars franchise and Marvel Cinematic Universe delivering outsized field workplace performances and being the foundational belongings for the Disney+ streaming service. Even in case you don’t like Star Wars or Marvel, there’s little denying that these purchases appear to be bargains looking back. The monetary outcomes converse for themselves.

Disney goes on to defend its acquisition of twentieth Century Fox. The firm argues that this transaction was “critical to better positioning Disney to address key secular shifts in the media sector” and goes on to make the case as to why. Disney factors to how the Fox buy broadened its model (FX, Hulu, NatGeo, Star, and so forth.) and mental property portfolio (Avatar, X-Men, Simpsons, Deadpool, and so forth.) and offered the corporate with a “deep bench” of expertise, together with Dana Walden, who’s a future CEO candidate.

Disney goes on to right factual errors in Peltz’s argument towards the Fox buy, overtly questions whether or not he’d want a competitor have bought Fox, and goes on to clarify why the corporate didn’t overpay for twentieth Century Fox. All of that is compelling, even when the acquisition worth of Fox does seem excessive upon superficial inspection.

As I’ve mentioned earlier than, that is my most important hesitation with critiquing the twentieth Century Fox transaction. Sure, it seemed like method an excessive amount of to pay, even on the time and particularly as in comparison with Disney’s earlier trio of acquisitions. However, I’ve the self-awareness to acknowledge there’s loads I don’t know.

Betting towards Bob Iger on the subject of M&A is like betting towards James Cameron on the subject of blockbusters. They know greater than you, whoever you’re, so simply don’t do it. Consequently, I’ll put aside my novice, surface-level impression of that deal and defer to Disney and Iger. They’ve earned it.

In essentially the most humorous slide of Disney’s presentation, it makes use of Peltz’s personal phrases towards him, by way of a CNBC interview final week that…didn’t go so nicely! Without query, if that interview had been your solely publicity to this proxy combat, you’d assume Peltz was out of his ingredient and presumably solely doing this to be a chaos agent.

Peltz didn’t have many good, substantive solutions for what he’d convey to the desk and a few of his claims had been factually inaccurate. Other interviews and arguments have been way more persuasive, so we view this slide extra as an amusing eye-poke than a compelling case made by Disney.

Disney then goes on to rebut a few of Peltz and Trian’s claims about motivations. These don’t strike me as worthy of highlighting. It’s spin in each instructions–Peltz desires to forged himself because the savior and Disney desires to border his because the villain, desirous to oust Iger. Neither mirror actuality, which is extra nuanced and messy.

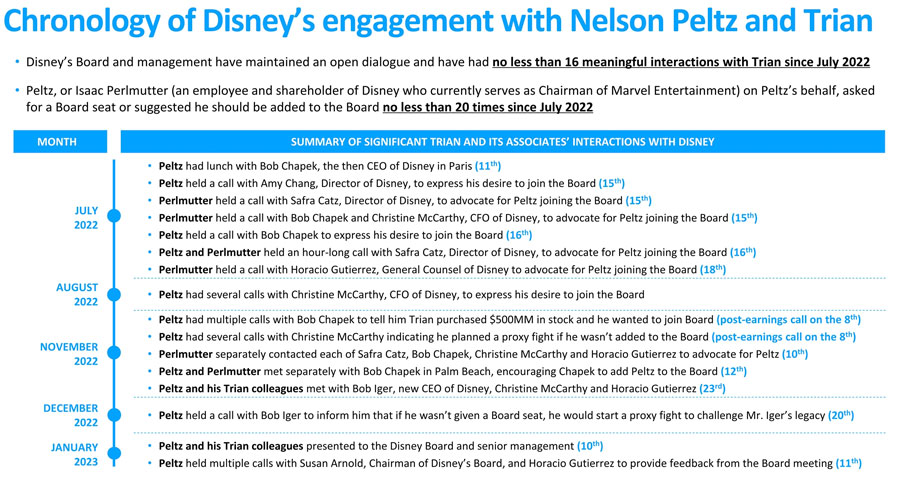

Disney’s SEC presentation concludes with a timeline of the corporate’s engagement with Peltz. The very first thing that ought to stick out is what number of instances that Chapek and Peltz met (and in addition that Ike Perlmutter was an obvious catalyst for this, due to course he was). Now distinction that with how new CEO Bob Iger has basically given Peltz the chilly shoulder.

Disney’s SEC Proxy Statement offers ‘color commentary’ right here: “Mr. Perlmutter said he and Mr. Peltz supported Mr. Chapek, and that adding Mr. Peltz to the Board would help Mr. Chapek counter recent headwinds he had faced, solidify his position as CEO, and preempt any other potential shareholder nominations of director nominees at the 2023 Annual Meeting. He said without Mr. Peltz there, former executives including Mr. Iger, would be back at Disney.”

That paints a clearer image of why issues performed out how they did. Chapek was extra receptive to Peltz as a result of the beleaguered CEO wanted allies. Previously, we speculated that Disney’s Board of Directors would possibly’ve introduced again Iger to gear up for this combat, feeling that Chapek was lower than the duty. With this added information, it’s doable that it wasn’t a matter of Chapek not being suited to battle–possibly Chapek didn’t wish to combat as a result of he wished an ally on the Board.

In phrases of commentary, I truly wish to begin by revisiting and supplementing my evaluation of “Restore the Magic” from the final submit. To be clear, I don’t assume Nelson Peltz has altruistic motives. It’s uncertain that any cheap particular person truly thinks that Trian is interested by “Restoring the Magic” in the identical sense that followers need it restored. That’s merely the advertising and marketing slogan–and similar to most advertising and marketing, it’s BS.

Peltz nearly actually doesn’t care concerning the intangibles or the corporate’s inventive legacy, historical past, and so forth. This is exactly why I drew a distinction between Peltz and Roy E. Disney, who had a vested stake and real ardour for the corporate’s inventive legacy. The interviews with Peltz clarify that he doesn’t actually care or grasp any of that. Quite merely, he desires to see the corporate turn out to be extra worthwhile, shift focus to parks (in all probability for the constant money circulate), lower spending on streaming, and reinstate the dividend by 2025.

Obviously, Peltz being a company raider brings with it wholesome skepticism about his motives. Some may need the angle that such people are by no means good for manufacturers and their followers.

To ensure, there may be an inherent stress between buyers and fanatics. It does seem to be, as a rule, Wall Street positive factors come on the expense of followers. Cost-cutting and worth will increase are used to juice share costs, to the detriment of customers. We have written about this sort of short-term mentality numerous instances, and the way it’s detrimental to Disney’s long-term well being.

However, that’s not what’s taking place right here. Peltz’s purported objectives have time horizons no sooner than 2025. As its presentation factors out, Trian Group is oriented on the long-term, and its monitor document and common funding dedication bears that out. This declare isn’t merely window-dressing to win over followers.

My view is that there doesn’t essentially must be a stress between buyers and followers when each are centered on the long-term well being and accountable progress of the corporate. The notion that Wall Street is “bad” for manufacturers is misguided. Fairytales about passionate inventive visionaries single-handedly forging empires would possibly recommend in any other case, however enterprise acumen and monetary restraint are additionally essential. Industry and creativity can work hand-in-hand in direction of mutually helpful ends–the bottom line is each being centered on the long-run and never chopping corners.

The firm prioritizing short-term income at Walt Disney World and Disneyland is exactly the critique we and different followers have been making over the past a number of years. Again, Trian’s core thesis is that worth will increase and nickel & diming is short-term considering that places the model worth and long-term well being of Disney’s theme parks enterprise in danger. This is a degree we’ve made many many many many many many instances.

Some Disney followers have contended that Peltz’s older age means he’s essentially interested by milking Disney for short-term positive factors. I disagree. Warren Buffett and Charlie Munger are famously long-term worth buyers, even to this present day, regardless of their mixed age of 191 years previous.

You might simply as simply argue that since Peltz is older and has already collected wealth past what he can spend in his remaining years, he’s interested by legacy-building. Maybe Peltz is focusing on a prolific firm like Disney as a result of it’s a method of cementing his status lengthy after he’s gone. This isn’t my rivalry, it’s only a believable counterpoint. I gained’t fake to know what motivates rich buyers to do what they do, however in my opinion, age is irrelevant.

It’s truthful to not take Peltz’s claims at face worth or query whether or not he has ulterior motives. However, it’s additionally truthful to level out that it’s not clear and apparent that Peltz is unhealthy (or good) for the corporate. There has been vigorous debate by analysts and buyers by way of Bloomberg, CNBC, Fortune, Barron’s, Financial Times, and others as as to whether he’d be an asset to Disney. (Those are all hyperlinks to particular articles you could learn for a well-rounded overview of this combat.)

The solely factor that’s clear is that there isn’t any clear consensus about Peltz. Not amongst analysts, buyers, speaking heads–and even board members and management at firms that had been beforehand in Peltz’s crosshairs. Some within the latter camp vouch for him, together with these at Heinz and P&G who reward him for turning round these firms. In different instances, he’s not considered in a lot much less fond phrases. His monitor document–which is certainly blended–known as into query.

According to FT, “Peltz is widely considered to be a fairly constructive activist investor, according to people who have found themselves on the other side of the negotiating table.” A supply near Disney put it in blunt phrases: “As usual with [Peltz], you know, there’s always some kernel of truth, and there’s always some level of bullshit.”

In my view, it’s the kernel of reality that’s vital, and what that might do for Disney. The bluster doesn’t actually matter a method or one other.

Already, Peltz has prompted modifications at Disney. That is, except you consider that the abrupt bulletins of 3 BIG Changes at Walt Disney World to Improve Guest Experience & Value and Good Changes Coming to Disneyland had nothing to do with him, and it was whole coincidence that that information dropped hours earlier than Peltz launched his proxy combat.

To ensure, this isn’t completely attributable to Peltz. D’Amaro and different leaders at Walt Disney World have been keen to enhance visitor satisfaction, however had their palms tied. Iger was aware of this, expressed “alarm” at Walt Disney World worth will increase, and was involved that Chapek was “killing the soul” of Disney. All of that’s well-documented, and predates the Peltz proxy combat.

However, it’s not possible to dismiss the standoff with Trian and Peltz as enjoying zero function, particularly given the timing of the aforementioned modifications on the parks, Mark Parker’s elevation to Chairman, and institution of the Succession Planning Committee. At minimal, “Restore the Magic” has been an accelerant that has already fast-tracked plans that had been beforehand in movement.

Hence the assertion within the prior submit that company politics makes unusual bedfellows. To no matter extent an alliance exists right here between Peltz and followers, it’s one in all comfort. It’s not as a result of our values align, however as a result of he could be means to an finish. If he causes the corporate to focus much less on streaming and extra on the parks, and making Disney extra accountable–that’s a win for followers.

Beyond what has already occurred, the battle will nearly assuredly immediate further constructive modifications at Disney. In an try and undercut Peltz’s place, the corporate will possible voluntarily making among the requested modifications and enhancements to display that he can’t add worth since they’ve already carried out all of his options.

Among different issues, this implies reining in runaway spending on streaming content material, clear succession planning, and deleveraging. For Walt Disney World and Disneyland, it additionally possible means extra manageable worth progress, much less nickel & diming, and improved visitor satisfaction. It additionally simply would possibly imply park growth tasks are given the inexperienced mild, as a great religion displaying that there’s long-term imaginative and prescient of the parks and so they don’t exist to easily subsidize streaming losses. (Josh D’Amaro and Bob Iger simply spent the week touring Walt Disney World…there was possible a cause for that.)

With that mentioned, that is solely excellent news in case you’re primarily a fan of Walt Disney World and Disneyland, and never as an alternative centered on the Disney+ streaming service. The circulate of high-budget content material will possible gradual over time and its worth will improve, as Disney+ is solely not sustainable at current. From my perspective, that is nice information–I don’t actually care about Disney+ and am uninterested in the theme parks subsidizing different folly and failures. Others might disagree, and that’s high-quality.

At the top of the day, it’s just one board seat (at most). There’s solely a lot Peltz can do with that, and dismantling Disney and promoting it off for components (or no matter different fears followers have) most assuredly isn’t a type of issues. For me, it’s the battle that has the worth. This has already been very high-profile and the subject of exhaustive media protection–that may proceed to be the case because the battle heats up. So lengthy as Disney is heading off this combat, they are going to preserve making constructive modifications within the parks to display Iger is severe about “improving the guest experience by providing more value and flexibility.”

Need Disney journey planning suggestions and complete recommendation? Make positive to learn 2023 Disney Parks Vacation Planning Guides, the place yow will discover complete guides to Walt Disney World, Disneyland, and past! For Disney updates, low cost info, free downloads of our eBooks and wallpapers, and rather more, join our FREE electronic mail publication!

YOUR THOUGHTS

What do you concentrate on Disney’s response to the “Restore the Magic” Campaign? Did the corporate make a compelling case, or are its arguments flawed? Skeptical about that Nelson Peltz’s actual motivations, or assume he’s really interested by long-term success? Think this will probably be helpful for the corporate and followers on the finish of the day? Optimistic that this may push Iger to lastly get severe about selecting a successor or give attention to bettering visitor satisfaction within the parks? Thoughts on anything mentioned right here? Do you agree or disagree with our evaluation? Note that neither Disney nor Peltz introduced up politics or tradition wars of their shows; as such, all off-topic feedback about both will probably be deleted.

[ad_2]