[ad_1]

Posted: 11/7/22 | November seventh, 2022

As an avid journey hacker, I’m all the time in search of new methods to earn extra factors and miles via my on a regular basis spending. As a consequence, I earn over a million factors yearly, permitting me to get pleasure from every kind of free flights and lodge stays, upgrades, lounge entry, elite standing, and extra.

Travel hacking has saved me hundreds and hundreds of {dollars} through the years, and I wouldn’t be capable to journey as a lot with out it.

However, there’s historically been one enormous expense that has all the time been onerous to earn factors for: hire.

For years, journey hackers have taken benefit of short-term provides that waive bank card charges or gone via complicated procedures to pay their hire so they may get factors.

But these maneuvers had been all hit and miss and by no means lasted lengthy. Thousands of potential factors continued to be left on the desk.

Until now.

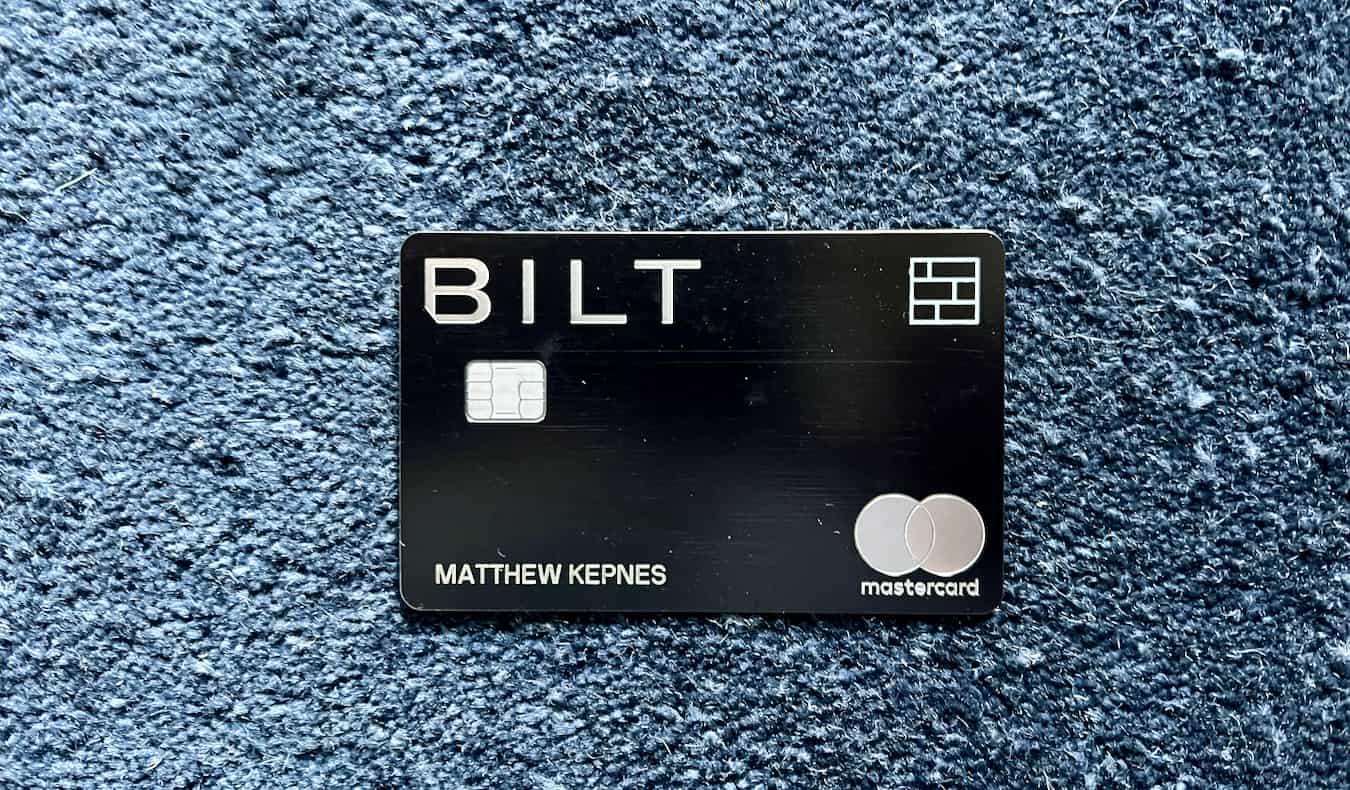

Earlier this 12 months, a card referred to as Bilt got here out. And it has modified the sport.

What is Bilt?

Bilt is a bank card that means that you can earn factors if you pay your hire (in addition to on on a regular basis purchases). You then use these factors such as you would every other rewards program: you should use them to e-book journey instantly, you possibly can switch them to journey companions, or you should use a few of the different redemption choices.

There are two methods to earn factors with the cardboard: by renting a Bilt Alliance property, or by utilizing the Bilt World Elite Mastercard®.

Bilt Alliance properties type a community of two million items throughout the US. But I’m not going to give attention to that. I’m going to speak about its bank card.

How does the Bilt reward card work?

Once you open a Bilt Mastercard® (which is issued by Wells Fargo and has no annual price), you go to the Bilt app or web site to arrange your recurring month-to-month rental funds.

Bilt then creates a novel checking account tied to your Bilt bank card in order that your hire is paid with an e-check fairly than via your bank card. This checking account is principally a authorized “dummy” account created as a workaround for bank card processing charges. You don’t use it for the rest, and you don’t withdraw or deposit cash from it.

Whenever these distinctive routing and account numbers are used to pay hire, your Bilt Mastercard® is charged for a similar quantity. (You nonetheless have to attach your private checking account to repay the cardboard every month.)

And, in case your property is old-school and solely accepts checks, you possibly can nonetheless pay along with your Bilt card via the Bilt Rewards app, and Bilt will ship a examine in your behalf.

It all takes about 5 minutes to arrange. When you’re carried out, you’ll be incomes factors in your hire. I take advantage of it, so I don’t depart any factors on the desk.

Bilt Reward Perks

Once your account is ready up, you’ll begin incomes one level per greenback spent utilizing the Bilt bank card on hire funds, as much as 50,000 factors every calendar 12 months. While the mileage wanted totally free flights varies drastically relying on many components, in the event you play your playing cards proper, that many factors may get you a free round-trip flight from New York to London.

And, whereas incomes factors for hire funds is Bilt’s principal draw, you’ll additionally earn two factors per greenback spent on journey (when booked instantly or via the Bilt Travel portal) and three factors per greenback spent on eating. You’ll get one level per greenback on all different purchases.

Just word that it’s important to make 5 purchases per 30 days (with no minimal spending requirement) to earn these rewards.

You can switch factors 1:1 to journey companions, together with American Airlines, United, Emirates, Hawaiian, Virgin Atlantic, Air Canada, Air France/KLM, Hyatt, and IHG.

The undeniable fact that they switch to American Airlines and Hyatt actually units this card aside (apart from the hire factor). No one transfers to American, so it is a enormous promoting level for this card, as a result of it’s the one solution to get AA factors with out having an AA card. And incomes Hyatt factors means that you can have a means out of the Chase system.

You also can redeem factors for health courses, like SoulCycle, Solidcore, Rumble, and Y7, and for gadgets within the Bilt Collection, a curated number of artisan dwelling décor gadgets. But redeeming for health courses comes out to round one level per cent — you get a greater redemption on journey purchases.

Additionally, purchases additionally aid you earn standing within the Bilt Rewards program, primarily based on the full factors earned yearly.

The tiers for these Bilt Rewards are as follows (subsequent tiers embody the whole lot within the aforementioned ones):

- Blue: Earn factors on hire and the power to switch them 1:1 to journey companions

- Silver (25,000 factors per 12 months): 10% bonus factors if you signal a brand new lease or renew your lease, and curiosity in your factors stability (on the FDIC revealed nationwide financial savings rate of interest)

- Gold (50,000 factors per 12 months): 25% bonus factors for brand spanking new leases/renewals and entry to a house possession concierge (who will stroll you thru the home-buying course of)

- Platinum (100,000 factors per 12 months): 50% bonus factors for brand spanking new leases/renewals and a free reward from the Bilt Collection of dwelling décor gadgets

While the perks within the increased tiers aren’t terribly thrilling, they’re a pleasant solution to earn much more factors in the event that they apply to you. But, even on the base degree, you possibly can nonetheless benefit from Bilt’s principal attraction: incomes factors on hire.

In addition to incomes factors, the cardboard additionally provides you:

- Trip cancellation safety and interruption protection

- Trip delay reimbursement (for delays of six hours or extra)

- Car rental collision protection

- Cell cellphone safety (as much as $800 USD)

- No international transaction charges

- A free three-month DashPass and $5 USD off your first DoorDash order every month

- $5 USD Lyft credit score every month after taking three rides that month

Who is that this card for?

This card is fitted to anybody who desires to earn factors on their month-to-month hire. Once you arrange the net funds (you may also arrange auto-pay) and use your card 5 occasions a month, it’s largely a “set it and forget it” form of card. With no annual price, you don’t have anything to lose and solely factors to achieve.

The card is particularly geared towards vacationers and restaurant-goers, because it provides 2x factors spent on journey and 3x factors on eating out. It’s greatest paired with different journey bank cards which have higher perks, good welcome bonuses, and better incomes charges, although.

I’ll most likely begin utilizing the Bilt card as a substitute of my Chase Sapphire, as a result of I get a variety of Chase factors via enterprise spending, and I’m aiming to fly to Japan subsequent 12 months, so I would like these AA factors (AA is a associate with Japan Airlines).

Who is that this card not for?

As with any journey bank card, you shouldn’t get the Bilt card in the event you’re already carrying a stability or plan to hold a stability. Interest charges for journey bank cards are notoriously excessive, and the Bilt card isn’t any completely different, with hefty APRs of 19–27%. The factors simply aren’t price it in the event you’re paying curiosity every month.

This card can be not for anybody with poor credit score, as you want good or glorious credit score to qualify.

Furthermore, the Bilt card gained’t be for anybody in search of one with a giant welcome bonus (as there’s none), and it does depend towards Chase’s 5/24 rule (you possibly can’t open greater than 5 Chase playing cards inside 24 months). If you’ve already opened 5 Chase playing cards or wish to open extra, you would possibly wish to skip this one for now.

In sum, in case you are a renter and wish to earn factors on this main month-to-month expenditure, then it’s price contemplating the Bilt card. It’s utterly free, and straightforward to arrange, so there’s actually nothing to lose. Even in case your hire isn’t notably excessive, factors are factors, and the Bilt card could possibly be a pleasant further useful resource for incomes these coveted factors and miles (particularly in the event you fly American Airlines, as that is one in all their solely switch companions).

As the one rewards card that gives factors on hire utterly totally free, Bilt is a welcome new participant within the journey house. In my opinion, it’s actually a no brainer in the event you pay hire, so you can begin working towards some free flights and lodge stays!

Want to study all about factors and miles?

Stop paying full worth for airfare! Download our free information to journey hacking and study:

Stop paying full worth for airfare! Download our free information to journey hacking and study:

- How to select a bank card

- How to earn miles totally free flights & accommodations

- Is journey hacking actually a rip-off?

Book Your Trip: Logistical Tips and Tricks

Book Your Flight

Find an inexpensive flight by utilizing Skyscanner. It’s my favourite search engine as a result of it searches web sites and airways across the globe so that you all the time know no stone is being left unturned.

Book Your Accommodation

You can e-book your hostel with Hostelworld. If you wish to keep someplace aside from a hostel, use Booking.com because it constantly returns the most affordable charges for guesthouses and accommodations.

Don’t Forget Travel Insurance

Travel insurance coverage will defend you towards sickness, harm, theft, and cancellations. It’s complete safety in case something goes mistaken. I by no means go on a visit with out it as I’ve had to make use of it many occasions previously. My favourite firms that provide the very best service and worth are:

Ready to Book Your Trip?

Check out my useful resource web page for the very best firms to make use of if you journey. I listing all those I take advantage of once I journey. They are the very best in school and you may’t go mistaken utilizing them in your journey.

[ad_2]