[ad_1]

Scan our PassportCard Nomads evaluate to find the advantages and downsides of this progressive new journey insurance coverage firm. See for your self if it’s the best journey insurance coverage alternative for you!

In our 12 years of writing about journey, it’s uncommon that there’s one thing new within the journey insurance coverage area. We’ve talked intimately about journey insurance coverage choices for brief time period vacationers, long run vacationers, and even expats, and coated a lot of the main firms within the journey insurance coverage area.

Nevertheless, on this article we’re a brand new method to journey insurance coverage from PassportCard Insurance coverage. PassportCard international nomad insurance coverage is progressive as a result of it’s a completely app-based journey service.

Personally, we by no means take at journey with out ensuring we’ve got journey insurance coverage in place.

We’ve had a few conditions the place we’ve wanted journey insurance coverage: as soon as once I ended up within the hospital for 3 days in Thailand, and as soon as the place our son was injured in Greece.

We’re each okay now, however they had been annoying conditions, and having journey insurance coverage meant that we didn’t want the extra fear of an expensive, surprising medical invoice. See our “Do I want journey insurance coverage?” article for extra.

Getting reimbursed for journey insurance coverage is a problem

One of many primary hassles with utilizing journey insurance coverage is that many insurers require you to pay out of pocket to get handled. You’re then paid again whenever you file a declare. As you’ll be able to think about, that is fairly annoying, and particularly regarding if you happen to’re low on funds.

When our son reduce his eye on a bit of playground tools in Greece, we had been compelled to pay out of pocket for costly non-public medical care, as that was all that was accessible. We then needed to contemplate getting a reimbursement from the journey insurance coverage firm after the actual fact. We had been fortunate that it was just a few hundred Euro.

There have to be a greater approach.

That’s the place PassportCard Nomads is available in.

PassportCard Nomads Insurance coverage Evaluate

PassportCard Nomads is mainly a journey insurance coverage bank card that allows you to you employ an app to entry and handle your journey insurance coverage.

In an emergency, observe three fast steps to make use of the cardboard:

- Open the app.

- Select the service you want (cash is added to your card for use instantly).

- Use the cardboard to pay for medical care.

All you have to do is swipe the purple card and PassportCard Nomads pays for medical care.

That’s the place this insurance coverage is completely different. PassportCard says it’s is the one insurer that settles claims in actual time, probably inside minutes.

You’ll be able to prolong or cancel anyplace, or any time.

To get costs, and study extra about plans and particulars, get a quote on the Passport Card Nomads web site right here.

Who’s PassportCard Nomads insurance coverage for?

PassportCard Nomads insurance coverage is generally aimed to digital nomads and distant employees who’re away from their house nation who need to get expat journey insurance coverage.

It’s typically aimed toward for youthful vacationers and long run vacationers (however they do have a plan that may cowl as much as age 65).

How does PassportCard Nomads work?

PassportCard is a pay as you go card which pays in your medical companies. Simply load it by way of the app, no questions, no paperwork, no problem.

To get PassportCard insurance coverage, go to their web site and buy a plan. (There are particulars on the plans they provide later on this put up.)

They’ll ship your private, bodily, purple Nomads Card inside seven enterprise days of buying your coverage.

Signal into the app, and end establishing your account and preferences.

If you have to make a declare, open the app, request funds, and pay in your medical service with the cardboard.

What are the potential drawbacks?

As a result of PassportCard nomads works like an everyday bank card, it ought to work in all international locations on this planet. There are a number of areas of the world the place the VISA community doesn’t work; sanctioned international locations for instance.

There’s additionally the small likelihood that the VISA community is down, because of technical issues. In both case, you’d simply must pay out of pocket, and get reimbursed later, identical to common journey insurance coverage.

As a result of Passport Card Nomads insurance coverage is app based mostly, you may additionally run into an issue if you happen to can’t entry the app.

IF you’re in a spot the place there’s no knowledge or Wi-Fi, you received’t be capable of entry the app so as to add funds in your emergency. Equally, if one thing catastrophic occurs, and you could possibly be so badly sick or damage that you could’t use the app so as to add funds.

If there isn’t Wi-Fi accessible, or you’ll be able to’t use the app for another cause so as to add funds, you then’ll must pay up entrance and get reimbursed later, identical to with different journey insurance coverage insurance policies.

Typically, I’d guess that the probability of any of those occurring is extraordinarily low. Even when they do occur, you’re nonetheless coated by reimbursement in your up-front prices, identical to different journey insurance coverage insurance policies.

PassportCard Nomads protection doesn’t robotically misplaced baggage. In the event you’re searching for baggage cowl, chances are you’ll must get that individually.

Nevertheless, you may get an add-on for theft of digital camera or laptop computer, or elective protection for bags and private gadgets.

How a lot does PassportCard insurance coverage price?

Plans begin at $59 a month.

What plans are supplied?

PassportCard gives three plans, all of which include a purple journey insurance coverage card:

- Starter – for brief time period vacationers as much as 6 months

- Distant – an prolonged plan for as much as 12 months

- Full – for many who have settled down and relocated to their chosen vacation spot

Starter Plan

The Starter plan begins at $59/month.

It’s beneficial for vacationers which have a house base, and journey sometimes.

Deductible: 0

Age: 18-45

Protection: as much as $500,000 per coverage interval

You’ll be able to customise the Starter plan by including lack of baggage, excessive sports activities, theft of laptop computer or digital camera, and extra.

The Starter plan doesn’t cowl journey within the USA.

Distant Plan

The Distant plan begins at $119/month.

This plan is beneficial for long term vacationers and distant employees. It contains annual checkups and outpatient cowl.

Deductible: 0

Age: 18-45

Protection: as much as $1,000,000 per coverage interval

You’ll be able to customise the Distant plan by including lack of baggage, excessive sports activities, theft of laptop computer or digital camera, and extra.

The Distant plan doesn’t cowl journey within the USA.

Full Plan

The Full plan begins at $200/month.

The Full plan is the one plan that covers nomads travelling to the USA. It additionally contains emergency medical care, elective care and has wellness profit plan.

Deductible: varies

Age: As much as 65

Protection: as much as $3,500,000 per coverage interval

You’ll be able to customise the Full plan.

The place on this planet am I coated?

In order for you protection to the USA, you’ll want to decide on the Full Plan, which is the one plan that features cowl within the USA.

The Normal and Distant plans embody protection to virtually each nation on this planet besides the USA.

You’ll be able to add an prolonged medical insurance coverage protection for the next international locations, which aren’t a part of the default cowl: UK, China, Hong Kong, Taiwan, Brazil, Singapore, Switzerland.

What occurs if I don’t have my card?

The coverage is energetic with or with out the cardboard.

The benefit of the cardboard is that it’s loaded with funds to pay the medical bills. In the event you pay by your self, Passport Nomads reimburses your bank card or checking account.

Can you purchase PassportCard Nomads insurance coverage overseas?

Sure, you should buy PassportCard Nomads insurance coverage when you’re overseas.

Is there a deductible?

There’s no deductible for the Starter and Distant Plans. The deductible varies with the Full Plan, relying on the choices you select.

Can I prolong my insurance coverage whereas on my journey?

Sure. You’ll be able to prolong or cancel.

Is COVID-19 protection included?

COVID-19 cowl is included.

All three plans cowl inpatient therapy in case of an infection underneath the coverage, topic to the precise plan you buy, and the small print of the plan. See your particular coverage for particulars.

The PassportCard Nomads website says “COVID-19 detection exams may also be thought-about a medical expense in circumstances that justify testing in case of suspicious signs or clear publicity to a affected person recognized with Coronavirus“.

Do I want to make use of the PassportCard docs?

You aren’t required to choose a health care provider beneficial by PassportCard Nomads. Nevertheless, they will join you with multilingual medical consultants if you happen to’d like.

What does the app do?

You’ll want the app to load the cardboard with funds, seek for healthcare suppliers close by, handle claims and consider well being plan advantages.

The app is accessible on Google Play and the App Retailer for iPhone and iPad.

Right here’s a bit extra on the app from the PassportCard Nomads YouTube channel.

Who’s the underwriter?

The underwriter is DavidShield Insurance coverage Firm Ltd.

Want extra particulars?

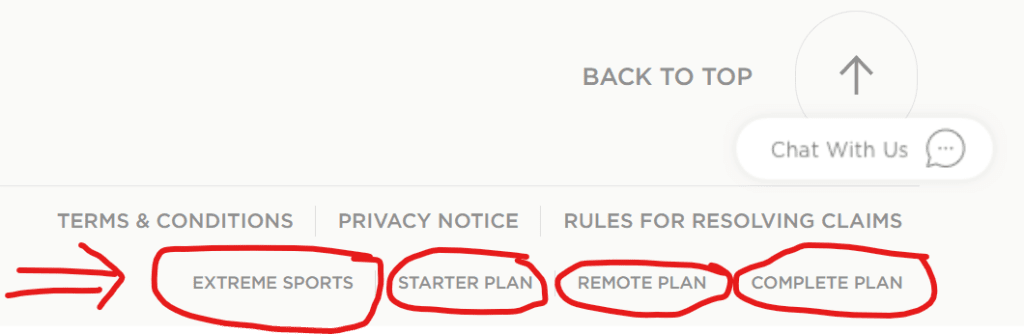

As a result of journey insurance coverage insurance policies can change with out warning, look over the insurance coverage coverage before you purchase. You could find hyperlinks to particular insurance policies within the footer of the PassportCard Nomad web site, proven beneath.

To get costs, and study extra about plans and particulars, get a quote on the Passport Card Nomads web site right here.

Wish to study extra about journey insurance coverage?

[ad_2]