[ad_1]

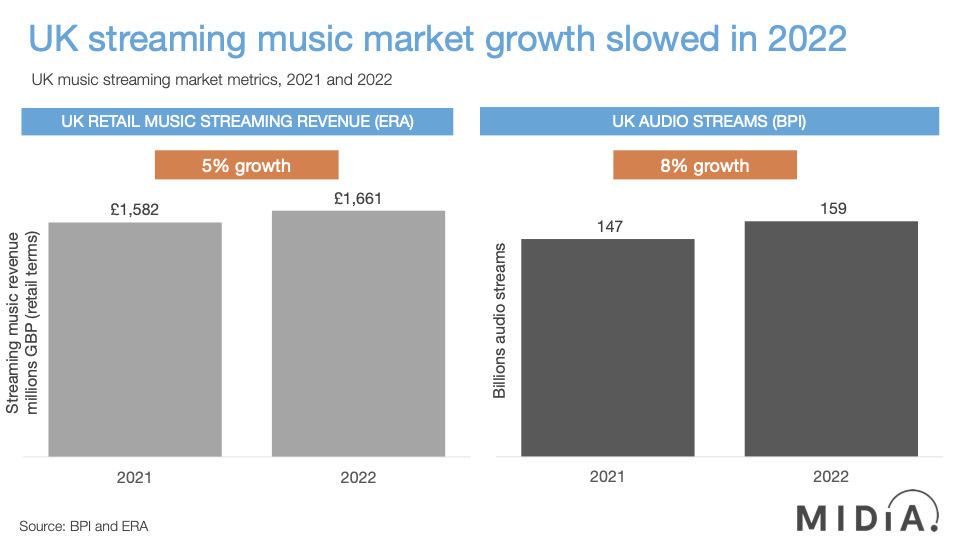

ERA, The UK commerce affiliation for leisure retailers launched its annual estimates for the UK leisure market, exhibiting robust development for video however much less spectacular will increase for music and video games. The streaming slowdown has been on the playing cards for a while now and there may be an argument that the robust development recorded in 2021 was boosted by the mixture of the worldwide economic system’s catch-up course of that 12 months, following the pandemic-depressed 2020 and the additional impetus delivered by upfront funds for non-DSP streaming. By Q3 2022, international label streaming revenues have been up by 7%, in comparison with 31% for a similar interval one 12 months earlier. Now ERA estimates* that UK retail streaming revenues have been up by simply 5%. Meanwhile, the BPI – whose numbers are based mostly on precise market information – reported complete audio streams have been up by 8% within the UK. A transparent streaming market pattern is starting to emerge.

There are not any two methods about it, 2023 goes to be a difficult 12 months. The sheer quantity of disruptive tendencies is unprecedented in fashionable instances, and this comes at the very same time that the Western music streaming market is starting to gradual. An ideal storm. But slowdown doesn’t must imply decline, not less than not for subscriptions. MIDiA’s information reveals that buyers are going to chop down on going out and on actual reside occasions earlier than cancelling subscriptions, and since they are going to be going out much less, they may want extra to maintain them occupied at residence. So, streaming subscriptions (music, video, and video games) might show to be the reasonably priced luxuries that hold shoppers entertained all through the approaching 12 months. Holding onto subscribers ought to, subsequently, be an achievable aim – including giant numbers of latest subscribers, although, could also be a step too far, notably in markets most impacted by the financial headwinds. Emerging markets could be a unique story.

Ad supported although, is a unique story. If general shopper spending softens, then so too will advert spend. With advert revenues representing 27% of all streaming revenues, a major drop in advert income in 2023 (e.g., -8%) may, in a bear-case state of affairs, be sufficient to gradual general international streaming income development nearly to a halt. Non-DSP was a significant driver of trade development in 2020 and 2021, however as most of it’s advert supported, this phase is way extra weak to financial pressures than subscriptions. Non-DSP is a phase for intervals of lots, maybe much less so for instances of shortage.

If the worldwide streaming market finishes 2022 with the 7% development that it’s at present monitoring to be, will probably be totally in step with the bear-case state of affairs that MIDiA printed final 12 months. We would a lot somewhat have had it tracked to our growth-case fee of 27% however, sadly, this seems like it could be a type of conditions the place MIDiA’s glass-half-empty view proved to be on the cash.

The subsequent few months will present a a lot clearer image, with the large labels, publishers and DSPs reporting their full 12 months figures. Until then, take into account this the primary notice of warning.

For extra perception on what 2023 might maintain, be a part of the MIDiA analyst workforce for our free-to-attend 2023 predictions webinar on Wednesday 11th January.

* ERA did a significant restatement of its 2021 figures – upscaling them by a fifth from the £1.3 billion that it reported in 2021 to £1.6 billion, having modified the underlying assumptions for its estimates.

[ad_2]